The debate between active and passive fund management in institutional investing has been raging for years. Institutional as well as retail investors tend to believe passionately in one versus the other, but what evidence is there to support either approach?

Passive Management

Fans of passive management don’t believe humans can outperform the markets and appreciate that buying and selling is limited within their portfolios, making it a very cost-effective way to invest. The strategy requires a buy-and-hold mentality, which means resisting the temptation to react or anticipate markets’ next moves.

Passive portfolios essentially own entire markets. They are typically comprised of one or more index or ETF funds that are tracked against common indices as their benchmarks. Whenever these indices switch up their holdings, the funds that follow them automatically switch up their holdings too.

There are many advantages to the passive approach. A portfolio comprised of index funds may achieve the desired rate of return with limited volatility against selected benchmarks. It is also easy to build a highly diversified portfolio; consider that the iShares core MSCI emerging markets ETF (IEMG) has over 2,400 names as of 6/30/2020.

The fact that they are not managed doesn’t mean passive portfolios can’t be customized to align with investors’ objectives and spending rate policies. Strategic asset allocation and over and under weighting asset classes such as large, small, value, growth, domestic and international is easily accomplished.

Passive strategies and index funds have a place in most institutional portfolios. They do well in an efficient market.

Active Management

Advocates of active management like its hands-on approach and the fact it requires someone acting in the role of portfolio manager, trying to beat markets’ average returns and take full advantage of short-term price fluctuations. It involves deep analysis, access to research and the expertise to know when to pivot into or out of a particular stock, bond, or any asset class.

Active fund managers will point out that in low yield and negative interest rate environments, owning the entire market via an index may present less persistent returns and more volatility.

Index funds tend to have concentrated sector exposure, which can present a higher level of risk in volatile markets.

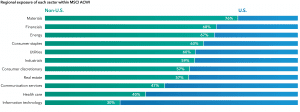

Consider that six stocks account for nearly 25 percent of the S&P 500, all but one of them in the technology sectors. The MSCI ACWI ex USA index has about 12% exposure to consumer discretion, while the ishares MSCI ACWI ex US ETF (ACWX) has about 20% exposure in financials (as of June 30, 2020).

In addition, some companies face regulatory and government pressure but are still part of passive portfolios. This poses downside risk, as does sector weighting that does not consider the economy, geopolitics, or consumer trends.

Active management may provide a more opportunistic returns and, importantly, downside risk, particularly in markets with significant volatility.

In the Middle: The Factor Strategy

If active and passive management are at two ends of a spectrum, there is another approach somewhere in the middle: factor.

While it can be considered an active strategy, factor investing doesn’t go as far as most fully active management. Rather than looking at individual securities and making frequent tactical moves, factor managers choose securities based on certain attributes that can be associated with higher returns. Generally speaking, there are two broad categories of attributes they consider: macroeconomic factors and style factors.

The former captures broad risks across asset classes while the latter aims to explain returns and risks within asset classes. Common macroeconomic factors include the rate of inflation, GDP growth and the unemployment rate. Style factors encompass growth versus value stocks, market capitalization, and industry sector.

What does history tell us about these approaches?

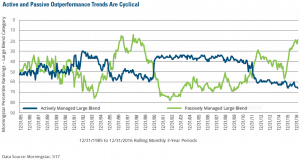

Passive management advocates have reason to be strong believers. Over the past 10 years passively managed index funds and ETFs have performed well—many better than active funds—and without the fees that are inherent in active management. According to a study by Goldman Sachs, only about 30% of actively managed mutual funds beat the largest exchange-traded funds over rolling three-year data from 1998 to 2019.

Source: GSAM Strategic Advisory Solutions/Portfolio Strategy, Morningstar, as of December 31, 2019, latest available.

However, it bears noting that we have just experienced the longest bull market in history, beginning in approximately March of 2009. We still don’t know if we have seen the end.

If we look at performance over a longer period of time, we see that passive management has not always had the edge.

The trend is for active management to do better in bear markets. We can see from this chart from Baron Capital that active management did better during recessions and market downturns, like the tech bubble of 2000 and the recession of 2008.

Active and passive trends are cyclical

We don’t box ourselves or our clients into “either or” scenarios. All of these strategies have benefits and disadvantages that are dependent on many criteria: the state of various markets and sectors, geopolitical trends and more. In our portfolios, passive funds usually serve as the anchor for long-term, lower risk investing, while active funds can help take advantage of market conditions and segments that can generate better risk-adjusted returns.

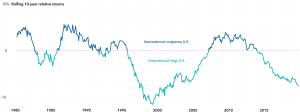

We are currently of the opinion that international funds are best managed with an active approach.

Why? Performance of passive international funds have significantly lagged the U.S. Not just recently, but for much of the last 20 years as shown in the graph and chart below.

Sources: American Funds, MSCI, Refinitiv Datastream, RIMES, Standard & Poor‘s. As of 8/31/19. Annualized 10-year total return of S&P 500 Index versus the MSCI World ex USA Index.

The chart below center compares two funds actively managed by American Funds to the iShares MSCI ACWI ex U.S. ETF and the benchmark MSCI ACWI ex U.S. (a world index).

Source: American Funds – All data is proprietary to Morningstar, Inc. Data as of 6/30/2020.

We also see that, while the U.S. is weighted toward technology and healthcare, international funds are skewing heavily toward materials, financials, and energy. This could present some significant headwinds, particularly in a market driven by momentum stocks. Consider that while information technology

stocks enjoyed the biggest gains during the second quarter, stocks in energy and materials lagged after a broad decline in commodities prices earlier this year.

stocks enjoyed the biggest gains during the second quarter, stocks in energy and materials lagged after a broad decline in commodities prices earlier this year.

What’s more, international markets are presently subject more than political, economic and trade uncertainties. For example, although the European Central Bank (ECB) provided monetary support by committing to purchase as much as €1.35 trillion of government bonds and corporate debt over the next 12 months, they also strongly suggested withholding share buy-back programs and reducing dividends.

Combine these issues with the low-yield, negative interest rate environment and it becomes exceedingly difficult to achieve spending rate goals with passive management tied to benchmarks. Therefore, it is important to have a flexible approach when investing in international markets. An active mandate allows managers to select companies and sectors that can provide the desired rate of return as well as downside resilience.

In other markets and sectors, we still include passive funds in our institutional portfolios to keep costs down and maximize returns. And, as conditions change, we will consider going back to a passive strategy with institutional funds.

| *The analysis is based on monthly rolling 3-year returns for the period 12/31/1981 to 6/30/2016. US OE Large includes all share classes in Morningstar’s US OE Large Growth, US OE Large Value, and US OE Large Blend categories. The performance of passive funds is calculated as the average 3-year performance of all index fund share classes in each category. The performance of active funds is calculated as the average 3-year performance of all non-index fund share classes in each category. Results for each category are then averaged and the differences between active funds’ averages and passive funds’ averages are calculated. |

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities

In other markets and sectors, we still include passive funds in our institutional portfolios to keep costs down and maximize returns. And, as conditions change, we will consider going back to a passive strategy with institutional funds. At FourThought Institutions, it’s consistent with our key investment principles including the one we all know: “Preserve the goose that lays the golden eggs.”

Patrick Baumann, CFA®

Patrick Baumann is an international finance professional and CFA® charter holder with a background in managing the assets of endowments and large corporate retirement plans. He is the Chief Investment Officer and senior consultant for FourThought Institutions.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective, and past performance is no guarantee of future results. Although all investments involve risk, including possible loss of principal, some strategies involve more risks; international investing involves political, liquidity and currency risk.

*US OE Large includes all share classes in Morningstar’s US OE Large Growth, US OE Large Value, and US OE Large Blend categories. The performance of passive funds is calculated as the average 3-year performance of all index fund share classes in each category. The performance of active funds is calculated as the average 3-year performance of all non-index fund share classes in each category. Results for each category are then averaged and the differences between active funds’ averages and passive funds’ averages are calculated.

Glossary of Terms and Acronyms ACWI: All Country World Index ACWX: ACWI Ex-US Index MSCI ishares ETF: Exchange-traded fund iShares: A family of exchange-traded funds managed by Black Rock. MSCI: Morgan Stanley Capital International