One of the four key principals of our investment strategy at FourThought Institutions is summarized in the statement, “Don’t eat the goose!” This is an obvious reference to Aesop’s “The Goose that Laid the Golden Egg.”

Stock dividends are like golden eggs. To preserve them we must know the companies that pay them.

This 1500-year-old fable is so ingrained in our social fabric that when we hear it we instantly understand its meaning and agree with it. This is a moral we seem to have always known. The fable teaches us the perils of greed and living beyond one’s means. There is also something about it that makes us thankful for what we have.

The Goose as a Metaphor for Dividend-Paying Portfolios

For our clients, the “goose” is a diversified portfolio of carefully selected companies that pay a good dividend (the golden eggs) to shareholders. What’s more, they steadily increase the amount of their dividends so shareholders can use the proceeds to enjoy their preferred quality of life.

How do We Protect the Goose?

At FourThought Private Wealth, our investment committee specifically looks for companies paying dividends that are secure and growing. We have developed a process for doing that, which has shown success.

The golden eggs are dependent on the health of the goose. Likewise, the dividend payments are dependent on the health of the companies that generate them. This leads to the question:

In a pandemic, can we quarantine the goose?

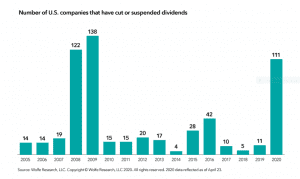

Covid-19 has decimated the revenues of thousands of companies. Some great companies like Boeing and Disney have cut or eliminated their dividends to preserve cash so they can survive. The exhibit below shows the number of U.S. companies that have cut their dividends this year, up over 1000% from 2019.

Number of companies that have cut dividends.

Political and Social Pressures are Playing a Role

In addition to cash drain, there is now a political and social calculus that must be considered. There is concern among some that if a company receives help from the government, it shouldn’t simply turn around and send money to shareholders. This makes sense. If a business is in such dire straights that it needs a government bailout, it should not make a distribution to owners.

In Europe, the European Central Bank has applied more pressure than in the U.S., and many companies are strongly encouraged not to pay dividends.

Some Companies Are Still Paying Dividends. How Do We Find Them and Protect the Goose?

This week we interview two of FourThought Private Wealth’s investment committee members to ask them about FourThought’s processes for finding those rare geese that still pay dividends and help smooth out income volatility.

Patrick Baumann, CFA®

Patrick Baumann, CFA® is a Chartered Financial Analyst who serves as FourThought’s Chief Investment Officer and leads FourThought Institutions, our division focusing on companies and institutional clients. He co-chairs the investment committee. Prior to joining FourThought he spent two decades with the technology and global defense contractor Harris Corporation (NYSE: LHX), where he served in several corporate finance roles and ultimately as corporate treasurer. His experience as a corporate insider with an S&P 500 company brings valuable perspective to FourThought’s processes.

Jake MacFarlane is a financial analyst with FourThought. Using the latest research technology, he personally analyzescompanies using a set of criteria and guidelines our committee has developed. His role is to dig beyond the surface to gain a deep understanding of what is happening in the companies we may considering for our dividend-paying portfolios.

Jake MacFarlane

FourThought: Patrick, when looking for dividend-paying companies, what are the basic criteria FourThought uses in its initial screens?

Baumann: There are a lot of factors we consider. We start with the nature of the industry and the macro environment. For instance, given the current environment, several companies in the energy, travel and entertainment sectors have opted for financial flexibility and cut dividends to preserve cash. Cruise lines and airlines are good recent examples.

The geographic location of companies’ headquarters also matters. Consider that several European companies have either eliminated, reduced, or delayed their dividends because of the European Central Bank’s pressure. Thus, we look for well-managed companies that have explicit or implicit dividend policies.

We further screen for companies that have chosen to establish a record of increasing dividends over a long period of time, and that have leadership positions within their respective industries.

FourThought: As a former treasurer, what are some of the other things you look for in assessing the stability of a company’s dividend?

Baumann: I tend to focus special attention on the capital structure, because a highly leveraged company may be restricted by debt covenants that negatively affect dividend payouts. In addition, I like companies that have a management team with a strong commitment to the shareholders, overseen by an effective board of directors.

FourThought: It is pretty easy to look online for companies with good dividends. What do you look for that isn’t always obvious?

MacFarlane: We screen for dividend sustainability in companies that have a leadership position in the market. We look to see if they have innovative products, and we screen for top and bottom-line revenues that have consistently increased. Like many firms we consider the dividend coverage and payout ratios. However, we dig deeper to focus on the source of cash flows, earnings consistency, and the associated credit risk.

FourThought: What are some of the research tools you are using? Are these available to everyone?

MacFarlane: We have made a significant investment in technology and research platforms that private investors rarely use. Specifically, this gives us access to data that allows us to look at balance sheets, income statements and cash flows for the dividend-paying companies we are considering.

We have also developed a proprietary library of factors with which to identify companies that continue to grow earnings and provide attractive, risk-adjusted returns.

FourThought: For investors seeking stable dividends, what is your general advice regarding asset allocation now and for the next couple of years.

Baumann: There are several theories about investor preference for dividends and establishing dividend policies.

In the past, investors were able to estimate dividends by looking at a company’s balance sheet and historical payout ratios, as well as assessing the business cycles and reading the annual reports. A large, mature company would typically target a dividend payout ratio much higher than a start-up or a tech company.

However, post COVID 19, investors may have to navigate in some unchartered waters. Dividend-paying companies are facing headwinds from multiple directions including regulators, government, and boards of directors. In a near zero-interest rate environment, we recognize that dividend payouts will remain a critical source of cash flow for investors—hence the critical importance of understanding macro and microeconomics as well as geo-political environments at a deep level.

My general advice for navigating these waters is to have a diversified portfolio, seeking industries that can weather storms and have strong senior management teams at the helm.